The Daily Courant

An elegant daily newsletter presenting Puck's most prominent pieces of timely journalism and podcasts. The Daily Courant will let you know what the insiders in media, entertainment, technology, finance, and politics are really talking about, and what they are actually saying under their breath.

Already a member? Sign in

The Backstory

A weekly digest of Puck's most recent important work from the power corridors of Wall Street, Washington, Silicon Valley, and Hollywood. Co-founder and editor-in-chief Jon Kelly offers readers the stories behind Puck's most important pieces including some of the inside story that was left on the cutting room floor.

Already a member? Sign in

The Puck Crier

Already a member? Sign in

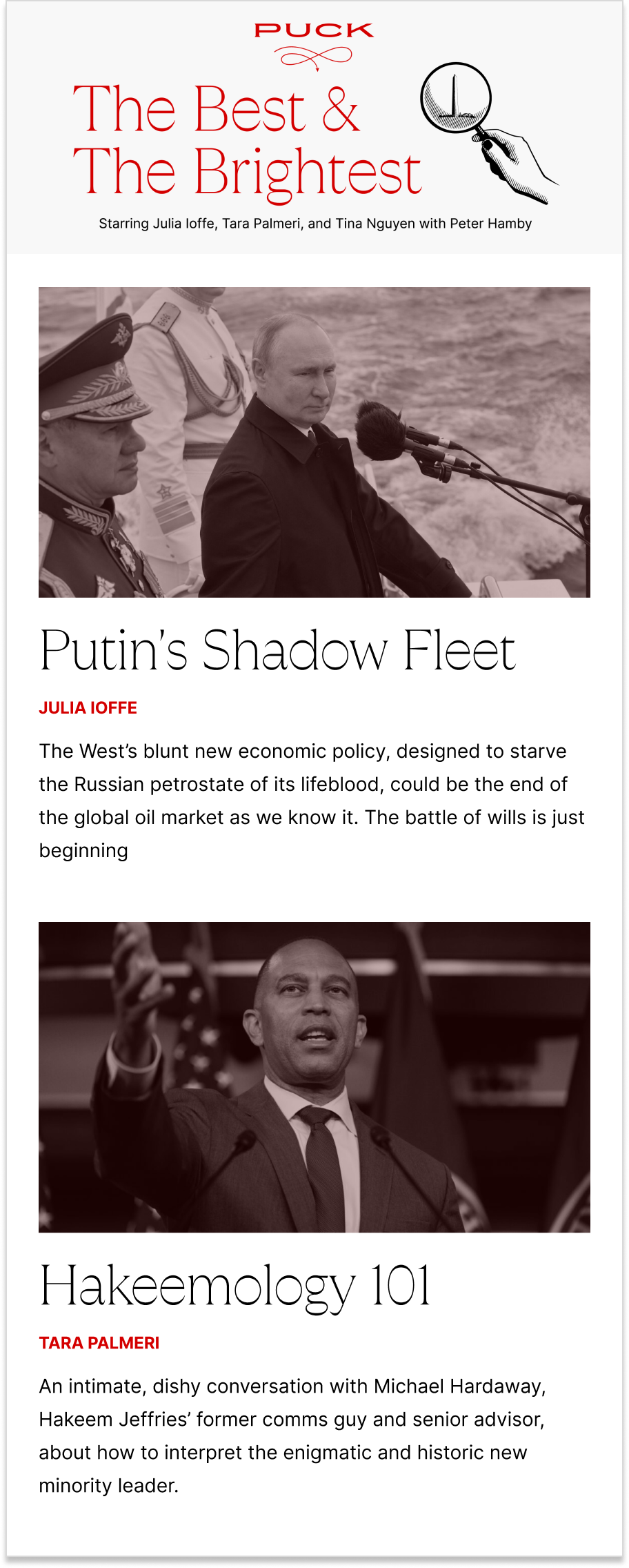

The Best & The Brightest

Puck’s daily political newsletter from Washington, featuring Tara Palmeri, Julia Ioffe, Peter Hamby, Tina Nguyen, Abby Livingston and Puck's new Chief Political Columnist, John Heilemann, on what’s really happening in this town—inside the White House and the Pentagon, on Capitol Hill, K Street, and the campaign trail.

Already a member? Sign in

The Best & The Brightest

Puck’s daily political newsletter from Washington, featuring Tara Palmeri, Julia Ioffe, Peter Hamby, Tina Nguyen, Abby Livingston and Puck's new Chief Political Columnist, John Heilemann, on what’s really happening in this town—inside the White House and the Pentagon, on Capitol Hill, K Street, and the campaign trail.

Already a member? Sign in

The Stratosphere

The Recode alum takes readers into the nexus of Silicon Valley and politics, explaining how the elite are remaking the world in their image.

Already a member? Sign in

What I'm Hearing...

An insider-friendly tip sheet from Matthew Belloni, who spent 14 years in the trenches at The Hollywood Reporter and five before that as an entertainment lawyer. Subscribers also receive What I’m Hearing+, Julia Alexander’s companion email focused on the streaming industry and the players who run it all.

Already a member? Sign in

What I'm Hearing +

The Parrot Analytics maestro offers cutting-edge and data-driven insights into what’s really going on in the streaming industry—a perfect complement to Matt’s industry-leading email, What I’m Hearing…

Already a member? Sign in

Dry Powder

Unique and privileged insight into the private conversation going on inside Wall Street, as told by the best-selling journalist and former M&A banker.

Already a member? Sign in

In the Room

Ace media reporter Dylan Byers lets readers into his notebook as he reports on the biggest stories (and egos) in the industry.

Already a member? Sign in

Baratunde's Private Email

A private email delivering the latest reporting, direct to your inbox, about race, technology, climate change, and democracy in America.

Already a member? Sign in

The Rainmaker

The Rainmaker is focused on how the players in Hollywood, Silicon Valley, Washington, and Wall Street are leveraging the courts (and their expensive lawyers!) for their own gain. It's brought to you by Eriq Gardner, America's foremost expert on media and entertainment law.

Already a member? Sign in

The Best & The Brightest

Puck’s daily political newsletter from Washington, featuring Tara Palmeri, Julia Ioffe, Peter Hamby, Tina Nguyen, Abby Livingston and Puck's new Chief Political Columnist, John Heilemann, on what’s really happening in this town—inside the White House and the Pentagon, on Capitol Hill, K Street, and the campaign trail.

Already a member? Sign in

The Best & The Brightest

Puck’s daily political newsletter from Washington, featuring Tara Palmeri, Julia Ioffe, Peter Hamby, Tina Nguyen, Abby Livingston and Puck's new Chief Political Columnist, John Heilemann, on what’s really happening in this town—inside the White House and the Pentagon, on Capitol Hill, K Street, and the campaign trail.

Already a member? Sign in

The Best & The Brightest

Puck’s daily political newsletter from Washington, featuring Tara Palmeri, Julia Ioffe, Peter Hamby, Tina Nguyen, Abby Livingston and Puck's new Chief Political Columnist, John Heilemann, on what’s really happening in this town—inside the White House and the Pentagon, on Capitol Hill, K Street, and the campaign trail.

Already a member? Sign in

Line Sheet

Lauren Sherman, a former top executive at Business of Fashion, is the preeminent fashion journalist of her generation. Line Sheet offers incisive reportage on all aspects of the industry and its biggest players. Every Wednesday, Lauren is joined by the beauty industry’s leading reporter, Rachel Strugatz, who writes the definitive guide to what’s happening across the category, from M&A to executive shuffles.

Already a member? Sign in

The Varsity

A professional-grade, insider-friendly tip sheet from John Ourand, the industry’s preeminent sports business journalist, covering the leagues, agencies, media deals, and the egos fueling it all.

Already a member? Sign in

Wall Power

A new biweekly private email offering unparalleled access to the global art market: the mega-auctions and galleries, elite buyers and sellers, and the power players who run this opaque world.

Already a member? Sign in

The Best & The Brightest

Puck’s daily political newsletter from Washington, featuring Tara Palmeri, Julia Ioffe, Peter Hamby, Tina Nguyen, Abby Livingston and Puck's new Chief Political Columnist, John Heilemann, on what’s really happening in this town—inside the White House and the Pentagon, on Capitol Hill, K Street, and the campaign trail.

Already a member? Sign in

The Best & The Brightest

Puck’s daily political newsletter from Washington, featuring Tara Palmeri, Julia Ioffe, Peter Hamby, Tina Nguyen, Abby Livingston and Puck's new Chief Political Columnist, John Heilemann, on what’s really happening in this town—inside the White House and the Pentagon, on Capitol Hill, K Street, and the campaign trail.

Already a member? Sign in